China asks Didi to delist from New York Stock Exchange

A story from the The China Project A.M. newsletter. Sign up for free here.

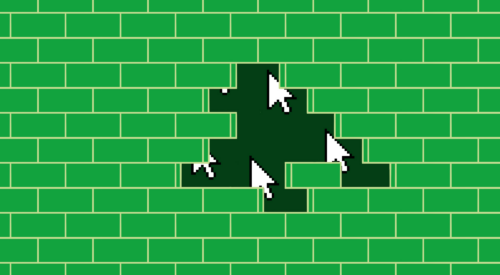

Over the Thanksgiving holiday, the Cyberspace Administration of China asked Didi to delist from U.S. markets over data security concerns, a decision that has left many U.S.-listed Chinese tech companies wondering who might be next.

- The government’s proposals include taking the company private or floating shares in Hong Kong, followed by a U.S. delisting.

- Indexes plummeted following the news, with the Hang Seng index falling by almost 4% in the past three days. Didi stocks plunged by 7% on Friday and shares of Softbank, Didi’s biggest shareholder, fell 5% in Tokyo.

The context: Didi has been in treacherous waters since its app was suspended in July after a rushed IPO angered regulators. But sources say Beijing may still backtrack from the latest request.

- Didi’s president Jean Liu (柳青 Liǔ Qīng) told associates in September that she plans to step down, citing the likelihood that the government would take over management.

- Other future casualties may include Alibaba and JD.com, both of which own logistics and cloud businesses that handle sensitive data.

The takeaway: Regulators have cast a wide net with the latest moves. Under the guise of national security, any U.S.-listed companies with reams of data might be on the chopping block.